Along with some bogus speeches about dieting and exercising more while drinking less, I made another resolution this year that I would finally take some control over my finances. I’m not going to lie, details aren’t my specialty and I hate keeping track of my individual accounts so much that I actually forget I have certain credit cards. My brain just blocks them out (ooops!). But in a effort to be an adult with a reasonable credit score, I decided to open a Mint.com account and link it to all of my various accounts, including my checking account, credit card accounts and college loans.

After surviving the sight of my total debt, I began to realize that with a little planning, my debt was completely manageable. Hell, I can even put money away for a trip next summer.

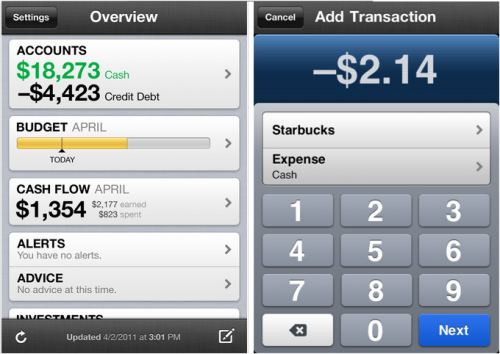

I’m completely obsessed with my Mint.com App. It tells me how much money I have total, how much I’ve spent all month, and how much money I still owe. Nothing feels more awesome than seeing my debt go down, even if it’s by $100. I feel like having it all in front of me is actually more relieving than stressful. The Mint.com App also helps me come up with a plan to put money away for future goals, as well as alert me to bill due dates. It’s also nice to have a budget and see exactly where my money goes and how to put a cap on my frivolous spending.